It's going to be a scenario that will continue to plague them for some time." "I think it's going to be difficult in their particular case to be able to move past that. "The challenge is that the brand has such a big name and the story was so prominent," Wisnefski told Banking Dive. "I think the messaging that they've put out is good," said Wisnefski, whose company specializes in reputation management.īut the 167-year-old bank's well-established brand is complicating the turnaround, he said. The bank is making "a complete recommitment to you, fixing what went wrong, making things right, and ending product-sales goals for branch bankers so we can focus on your satisfaction."

Īs part of an ad campaign dubbed "Re-established," a one-minute commercial last year referenced the bank's legacy as a carrier of goods by stagecoach. The bank's stock has lost almost $24 billion since the March departure of former CEO Tim Sloan, according to Bloomberg. To restore its reputation and earn back customers' trust, the San Francisco-based bank has scoured the marketplace for a new CEO and launched an ad campaign addressing its mistakes.īut the campaign has received mixed reactions from consumers and marketing experts, and the bank is hemorrhaging value during its search for a new top executive. The bank endured subsequent faux pas tied to its auto insurance, mortgage and wealth management divisions, and has agreed to pay more than $4 billion in the past three years to settle various regulatory disputes, according to the Winston-Salem Journal. The nation's fourth-largest bank has an image problem, stemming from a 2016 scandal in which employees opened millions of fraudulent accounts to receive sales-based incentives.

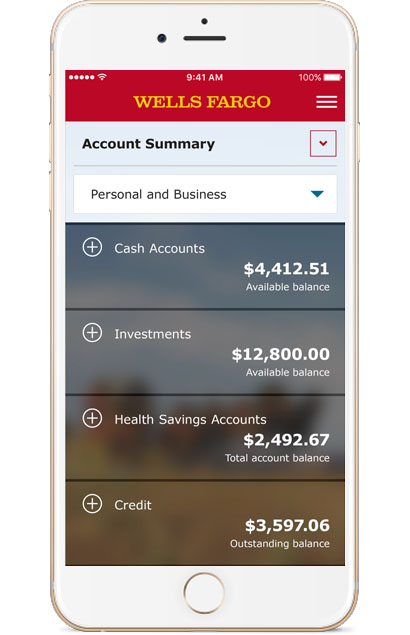

#WELLS FARGO IMAGE VIEWER SERIES#

As Wells Fargo attempts to rebuild its credibility following a series of public missteps, a rebrand might be in order, said Ken Wisnefski, founder and CEO of the digital marketing firm WebiMax.

0 kommentar(er)

0 kommentar(er)